Samsung Electronics builds a factory in Xi'an, and the Chinese storage market sees clear skies again

As early as the end of last year, there were reports that Samsung planned to invest billions of dollars to expand its 3D NAND production facilities in Xi’an, China.

As one of the three major production bases of Samsung Electronics in Xi’an, China (the other two are Hwaseong and Ping Chak, South Korea), Samsung Electronics had this plan as early as 17 years to fully increase the production capacity of the Xi’an plant.

As the world's largest chip maker, Samsung Electronics' every move is undoubtedly the vane of the world's storage industry. Despite being a major player in the storage industry, the downturn in the storage chip market for five consecutive years has still dealt a big blow to it.

Originally, with the gradual rejuvenation of the memory chip market, Samsung Electronics intended to fight a beautiful turnaround in 2020 and 2021, but the sudden "new crown" broke the expansion plan for the first half of 2020. Nevertheless, with the gradual stabilization of the domestic epidemic in China, Samsung Electronics will still accelerate the pace of construction in Xi'an.

What is the reason why Samsung Electronics attaches so much importance to this area of China?

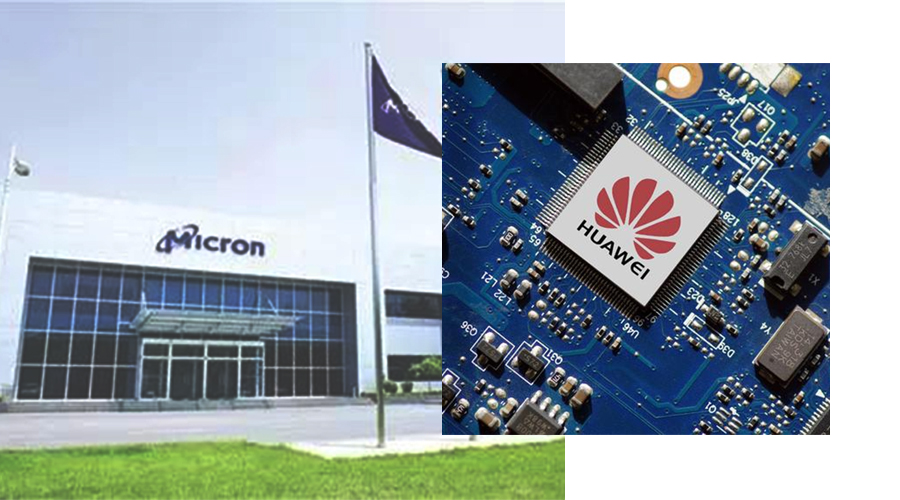

In the final analysis, it is the domestic market position. As a leader in China's smart industry, Huawei is also the world's leading provider of ICT (information and communications) infrastructure and smart terminals. With the continuous development in the past few years, Huawei will sprint to the global mobile phone hegemony, especially in the rapid development of the 5G mobile phone era. China alone consumes more than 30% of NAND Flash every year.

As of the end of 2019, Huawei's global mobile phone sales have reached 230 million units. Its 50% market share in the Chinese mobile phone market and the constructive achievements of surpassing the iPhone to become the world's second mobile phone manufacturer indicate that Huawei's goal of dominating the international market in the future is very promising. Huawei's future development also shows its commitment to memory chips. The demand is considerable.

Although Huawei, which was affected by the US "ban", once stopped chip transactions with Micron, this has instead promoted further cooperation between China and South Korea's memory chips. Huawei’s “de-beautification” process is accelerating, which is also an opportunity for the independent rise of the Chinese and Korean memory chip market and the domestic chip market.

With the comprehensive coverage of 5G mobile phones, new 5G mobile phones such as Huawei and OPPO have increased requirements for carrying capacity. LPDDR requires up to 8G and Flash almost reaches 128G. At the same time, due to the continuous development of the Internet, the demand for NAND Flash is also increasing due to the strong demand for data centers and servers.

The trade war between Japan and South Korea continues. The reason for Samsung’s move to China is the industry’s sustainable development requirements.

At the beginning of July last year, Japan issued strict export restrictions on semiconductors to South Korea, controlling fluorine polyimide (Fluorine Polyimide) used in the manufacture of mobile phone screens and OLED panels, photoresists used in semiconductor manufacturing, and high-purity hydrogen fluoride, etc. Purchase contracts for three chemical raw materials.

As the trade friction between Japan and South Korea continues to escalate, related Korean electronics industries such as Samsung Electronics and SK Hynix urgently need to find alternative solutions.

Samsung Electronics' choice to increase investment and cooperation in China will be a result of mutual benefit for both the Chinese economy and domestic enterprises.

Although the impact of the "new crown" has slowed Samsung Electronics' construction in China, the overall development momentum of NAND Flash is still not to be underestimated. We need to be optimistic about the storage market.